stock option sale tax calculator

UK Tax NI Calculator. That form should show 4490 as your proceeds from the sale.

How To Calculate Sales Tax Video Lesson Transcript Study Com

Ad Calculate profit or loss from buying and selling shares of stock.

. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. Subtracting your sales price 4490 from your cost basis 4500 you get a loss of 10. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Please enter your option information below to see your potential savings. The Stock Option Plan specifies the total number of shares in the option pool. January 29 2022.

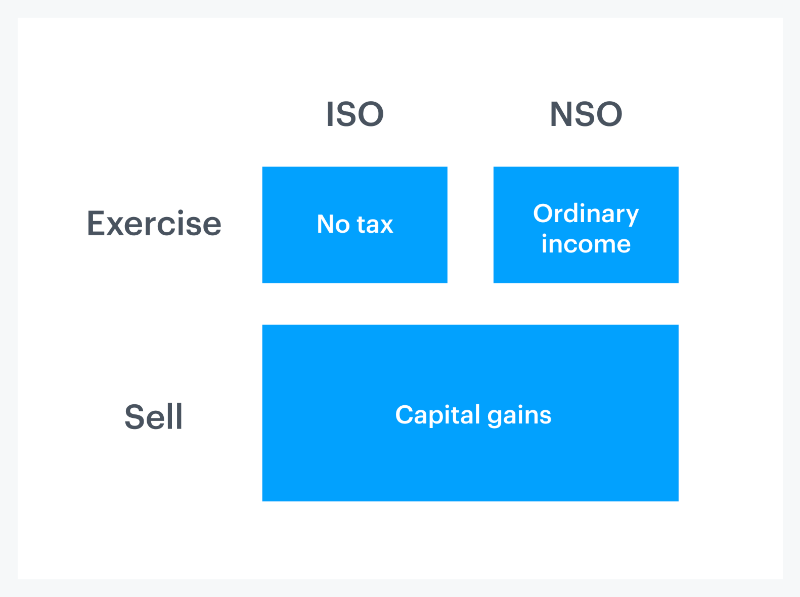

United States US Tax Brackets Calculator. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. Section 1256 options are always taxed as follows.

United States Salary Tax Calculator 202223. NSO Tax Occasion 1 - At Exercise. The number of shares acquired is listed in box 5.

The tool will estimate how much tax youll pay plus your total return on your non. There are two types of taxes you need to keep in mind when exercising options. Ad At 110 the Size of the Standard SPX Options Contract XSP Provides Greater.

Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. 40 of the gain or loss is taxed at the short-term capital tax. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Learn to Trade XSP Today. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. 60 of the gain or loss is taxed at the long-term capital tax rates.

On this page is a non-qualified stock option or NSO calculator. Non-qualified Stock Option Inputs. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Capital Gains Tax Calculator. Click to follow the link and save it to your Favorites so. Enter the number of shares purchased.

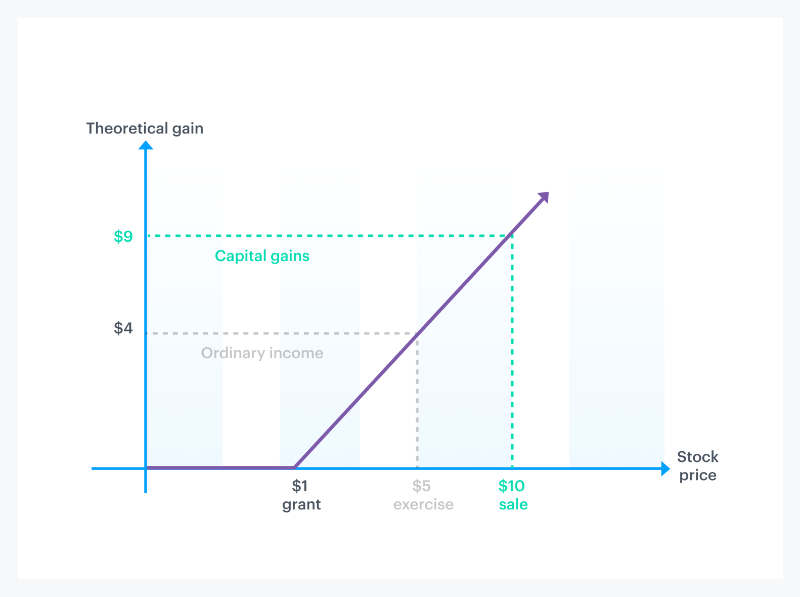

Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the.

On this page is a non-qualified stock option or NSO calculator. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. On this page is an Incentive Stock Options or ISO calculator.

This calculator illustrates the tax benefits of exercising your stock options before IPO. ETRADE helps make it simple. The AMT adjustment is 1500 2500 box 4 multiplied by box 5 minus 1000 box 3 multiplied by box 5.

Ad Avalara AvaTax plugs into popular business systems to make sales tax easier to manage. This permalink creates a unique url for this online calculator with your saved information. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

The tool will estimate how much tax youll pay plus your total return on your. And if you re-purchase the stock. Ordinary income tax and capital gains tax.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. How much are your stock options worth. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart.

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. Salary Income Tax Calculators. Ad Avalara AvaTax plugs into popular business systems to make sales tax easier to manage.

In our continuing example your theoretical gain is. Discover the Power of thinkorswim Today. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

United States Minimum Wage Calculator. Flexibility for New Index Options Traders. New Tax Laws Recently there has.

Ad Investing doesnt have to be complicated.

Reverse Sales Tax Calculator 100 Free Calculators Io

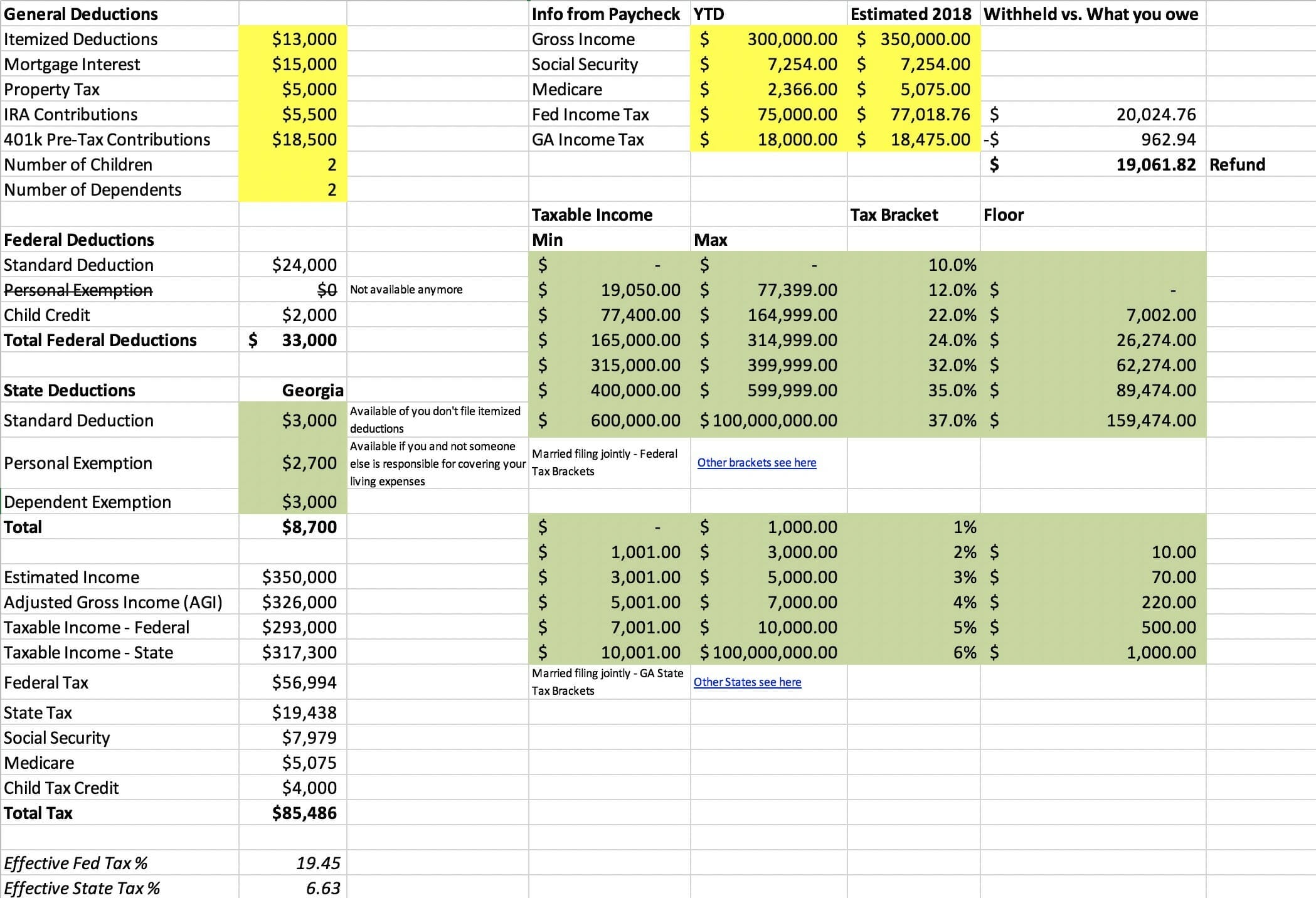

Income Tax Prep Checklist Free Printable Checklist

How Stock Options Are Taxed Carta

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How Stock Options Are Taxed Carta

New Functional Scientific Calculator Fx 991es Plus 1 75 4 Scientific Calculator Calculator Graphing Calculator

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Infographic How Can You Use Home Equity

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Net Profit Margin Calculator Bdc Ca

Credit Card Interest Calculator Excel Template New Relocation Expenses Worksheet Printable Worksheets And Best Templates Ideas

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Calculate Cannabis Taxes At Your Dispensary

Pin On E Commerce Business Strategy

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca